Even before the pandemic, the world economy was in a turbulent state. India’s real GDP growth rate was less than 5% in the first three quarters of fiscal year 2019-20, the lowest in the last six years up until that period. The outlook for the next few quarters then appeared bleak due to various constraints on economic activity producing a looming environment for the onset of a Financial Crisis.

Stock prices are an important indicator of a company’s profitability and its return to stakeholders, thus serving as a good indication of the country’s economy as a whole by gauging the performances of the Stock Exchange Indices.

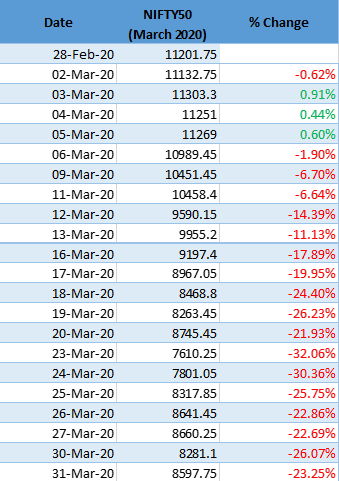

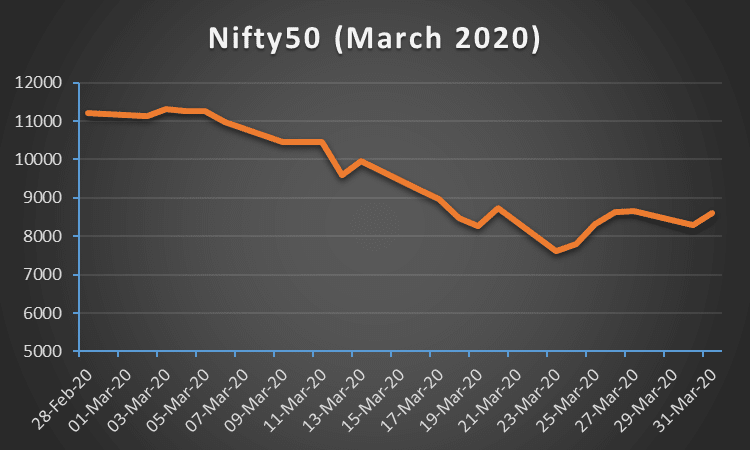

The onset of COVID-19 in March 2020, saw the Sensex drop by a record of nearly 3,000 points in one day, while Nifty50 had a 23% net change for the month of March 2020. The growth prospects of the economy for FY 2020-2021 had been sharply revised predicting a negative trend and the forthcoming financial crisis.

What is a Financial Crisis?

A financial crisis occurs when the usual functioning of Financial Markets and Institutions is disrupted, resulting in significant economic instability. Financial crises are often characterised by a sudden and widespread loss of confidence in the financial system due to factors that induce panic in the Investors, causing a ripple effect on the entire economy leading to a liquidity crisis and the slowdown or complete halt of the global markets.

Financial Crises can be divided into three stages, beginning with the crisis’ origin. Financial systems fail as a result of system and regulatory failures, institutional negligence of finances, and other factors. The next step involves the financial system collapsing, with financial institutions, firms, and consumers unable to satisfy their obligations. Finally, the value of assets declines while the overall level of debt rises. A prolonged financial crisis can have adverse impacts on short-term and long-term economic prospects and potentially lead to a recession, that goes beyond the loss of wealth or asset depreciation.

Are Financial Crises Predictable?

Although not predictable, financial crises are not uncommon, as they have happened for as long as the world has been trading in some form of currency. The regularity can be explained by the fact that all businesses and global economies are cyclical in nature. The upward trend sees wealth creation and an increase in disposable income of the public until stagnation, oversupply, overvaluation or other factors lead to a loss in confidence in the market resulting in a wide-scale financial stress or a crash.

Although undesirable and a harsh reality of principles of economics at play over the cyclical nature of businesses and economies, periods of financial stress on the systems at the macro and micro level provide for an evaluative opportunity for better regulations and policies to be implemented in an attempt to curb the monetary and financial damage on the onset of the next crisis.

Some examples and the reasons for the below-listed financial crises show different factors at play, but the end result is the same, investor loss of confidence in the market.

-

Wall Street Crash, 1929

This crisis was right after the roaring ‘20s in the US, where the ever-improving living standards and wages saw a period of reckless speculation and borrowing to purchase shares. The constant improvement and upward trend for the past couple of decades led to unrealistic optimism eventually leading to the Great Depression, lasting more than a decade. One cause of the fall was a massive oversupply of commodity crops, which resulted in a sharp drop in prices. As a result of the disaster, a slew of new rules and market-management instruments were implemented.

-

OPEC Oil Crisis, 1973

In October 1973, OPEC members imposed an oil embargo on countries allied with Israel in the Yom Kippur War causing a barrel of oil’s price to shoot up from 3$ to 12$ by the end of the embargo. Given that modern economies significantly depend on oil, the higher prices and uncertain conditions resulted in a bearish market and a severe loss of confidence in the market going forward, triggering a worldwide financial crash characterised by very high inflation and stagnation in economic growth.

-

Asian Financial Crisis, 1997-1998

The collapse of the Thai baht triggered the crisis in July 1997. Due to a lack of foreign currency, Thailand’s government was compelled to relinquish its US dollar peg and allow the baht to float. As a result, a massive devaluation swept throughout much of East Asia, including Japan, and debt-to-GDP ratios skyrocketed.

-

Global Financial Crisis, 2007-2008

It began in 2007 with a subprime mortgage lending crisis and grew into a worldwide banking crisis with the fall of investment bank Lehman Brothers in September 2008. Massive bailouts and other measures intended to restrict the spread of the damage failed, and the world economy entered a recession

-

COVID19 Pandemic, 2020

Indian Equity Markets witnessed their steepest one-day fall in absolute terms as risk sentiment took a hit after the WHO declared the COVID-19 outbreak a global pandemic. The pandemic caused widespread panic and uncertainty about the future of the global economy as the virus claimed millions of lives across the world. However, despite the severity and the speed at which the virus eclipsed the globe, markets rebounded quickly and the indices were reaching new soaring highs and a bullish sentiment of the market seemed to be on the horizon given the prospective growth trends.

Impact on the Indian Economic Sectors

-

Agriculture

Since agriculture is an essential category under the Government of India, the impact was not as hard-hitting as it was on the other sectors due to the insulation provided by the policies to protect the industry and its employees through subsidies and free movement of goods such as fruits, vegetables, milk, etc. Online platforms were heavily impacted as their demand soared but the supply was burdened due to the growing logistical and supply chain issues failing to meet the growing demands.

-

Aviation & Tourism

Aviation and Tourism were the main industries that took a significant hit during the onset of COVID. The decrease in Cash Flow and the growing debts taken to compensate for the losses accrued ended up folding many businesses amounting to massive lay-offs to both, White Collar and Blue Collar jobs. On the other hand, the innovations and technological advancements created and implemented to overcome the situation have proven to be fruitful in creating a paradigm shift in the operations of a business.

-

Pharmaceuticals and Medicine

India is the largest producer of generic drugs globally, with major export destinations being the US, UK, Canada, the Middle-East and the African Union. Due to the rise in prices of raw materials being imported from China, and the disruptions faced in supply chains, the Government of India was faced with the challenge to not only mitigate export losses but also to secure the necessary drugs and vaccines needed for the entire country.

-

Oil and Gas

The complete lockdown of the country was devastating to the automobile and industrial sectors which accounted for two-thirds of the total consumption in the Oil and Gas sector. India being the third-largest energy consumer in the world, a decline in the usage and consumption of this scale drastically lowered the manufacturing and industrial output of many industries in the sector in the following months, resulting in a sharp decline in Stock Indices and in effect, the overall economy.

Impact on Investors

The COVID-19 outbreak has had a substantial economic impact. Given the large population and the economy’s precarious circumstances, particularly in the financial sector, lockdown and social isolation had done nothing but exacerbate the situation.

Individual Investors’ willingness to invest in Mutual Funds and the Stock Market was severely impacted as a result of government measures to prevent the spread of COVID-19, and the Stock Market crash post-declaration of a pandemic by the WHO resulted in Investors being more risk-averse along with the growing trend of increasing Retail Investor participation in the Stock Market coming to a slowdown.

The key to building back Investor confidence and restoring market stability is coordinated and integrated efforts by the governments (central, state and local). Swift measures were introduced by the RBI, Income Tax Department and SEBI, among other Regulatory Institutions to allow extended timelines to meet regulatory deadlines and relax a few criteria to act as an economic stimulus and promote investing through digital platforms.

Measures to Shield Yourself from a Financial Crisis

For a large number of salaried individuals and owners of small businesses, a slowdown in the economy could lead to pay cuts and loss of jobs and can significantly harm the personal finances of an individual without a constant revenue stream. Thus, it is important to follow some common best practices to have the means and ability to shield oneself from the fallout damage caused by a financial crisis.

-

Build a rainy-day fund

Rainy-day fund is money that is set aside for unexpected lower-cost expenses such as maintenance or parking tickets. It is different to an emergency fund, which is usually reserved for larger and possibly life-altering scenarios. Depending upon the expenses and lifestyle of an individual, the funds should be easy to liquidate on short notice and last at least three to six months covering the day-to-day and liquid expenses.

-

Diversification of your Investment Portfolio

Diversification as a general rule of thumb, can almost never go wrong when it comes to building an Investment Portfolio. Its importance is highlighted even more during a slowdown or a crisis as it is important to understand that stocks from sectors producing essential goods such as consumer goods, pharma and financial services could or would be affected more than sectors producing relatively non-essential goods and products such as aviation, automotive industry, among others.

-

Make a Budget

If you don’t know how much money comes in and goes out each month, you won’t know how much you need for an emergency fund. And if you don’t have a budget, you have no idea if you’re living within your means or overextending yourself. It serves as a useful tool to introspect one’s financial standing and position during a given time.

-

Re-evaluating your Risk-tolerance

Markets being volatile and sometimes completely unpredictable during an economic slowdown means it is important to re-evaluate your risk tolerance while making financial decisions. It is important to focus on the long-term benefits and financial well-being rather than the short-term problems and hardships.

In general, the prevailing thought and often a fact is that Financial crises can cause a lot of hardship, stress and damage due to external forces acting out of one’s control. However, the regularity of it occurring once every few decades due to the global economy being cyclical in nature through its credit boom-bust cycle has shown and taught us a few lessons over the years to better mitigate, shield ourselves and sometimes even profit out of what might seem to be a situation full of despair. Regardless of whether you are an Investor or not, it is imperative to plan and set up your finances and funds in an organised and coordinated way so that they can be used at times when they are really needed, but at the same time, it’s also important to not panic and divest out of long-term commitments unless the situation really demands it.