A RICH HERITAGE

• Stewart & Co. and C. Mackertich, a legacy of 100 years with a rich heritage.

• 1994 – Stewart & Mackertich is born, as the two entities merge to create an

integrated Wealth Advisory and Equity Broking House.

• Establish themselves as an integrated Wealth Advisory and Equity Broking House,

catering to FII’s, Banks, Corporate, HNI’s and Retail clients (through Associated

Partners, Sub-Broker).

• Inspired by the rich heritage of the company, belief in building long term

relationships with clients and associates by laying emphasis on transparent and

ethical dealings.

• Sustenance through the ages is proof of our practice in the noble art of finance

with professionalism, skill and transparency.

• Emphasis on transparent and ethical dealings are backbone to our age old

sustenance

VISONARY PROMOTERS

❑ Mr. Sevantilal Shah: A stalwart in the broking industry with unparalleled expertise in the capital markets. As a member of the CSE and its

governing board, he had been instrumental in institutionalizing stock broking. He is the founder promoter of Stewart & Company.

❑ Mr. Ajay Kumar Kayan: Under the able leadership of Mr. Kayan, C. Mackertich progressed leaps and bounds through long lasting relationships

with Institutions, Corporate houses, HNIs, which he built brick by brick over the years. He along with Mr. Utsav Parekh, visualized the synergy

and paved the way for the formation of Stewart & Mackertich.

❑ Mr. Utsav Parekh: As a partner of Stewart & Company, he visualized the need for corporatisation in Investment & Merchant Banking and laid

foundation of SMIFS Capital Markets Ltd. as a leading Merchant Banking company in Eastern India. He has long lasting relationships with

leading corporate houses and is one of the most respected Merchant Banker.

❑ Mr. Yogendra Shah: Started his career as a member of the BSE. Since 1979 he built excellent rapport with leading corporate houses,

institutions and HNIs. He visualized the need to corporatize the broking business and was one of the first few brokers who corporatized his

individual membership

KEY MANAGERIAL TEAM

❑ Mr. Rahul Kayan, is CEO & Director of the Company. He holds a Bachelors Degree of Science in Finance & Marketing from Leonard N. Stern

School of Business, New York University. He has worked with Merrill Lynch – New York. He has 12 years of experience in Prime Brokerage,

Equity Research, Risk Management and Marketing of Equity, Mutual Fund, Structured & Debt Linked Product.

❑ Mr. Ashiwini Kumar Tripathi, is Managing Director of the Company. He has PGDM Degree with Specialization in Finance and has more than

25 years of experience in Capital Markets. He has worked with Wealth Management Advisory Services Limited, a once SEBI Registered

Portfolio Manager and has played an instrumental role in providing Portfolio Management Services to HNIs and Corporates.

❑ Mr. Sudipto Datta, is a Graduate in Economics, Post Graduate in Business Management and Post Graduate in Law, having 28 years of

diverse experience ranging from the field of Research, Investments, Debt Market, HR & Talent Acquisition, Stock Broking & Depository

Operations, Statutory Compliance & Legal.

Sudipto is associated with the Group over 25 years and had been the backbone to play an

instrumental role in formulating structured systems for the Group Operations, HR Policies, Regulatory Compliance and to hold the Legal

Fort.

❑ Shivaji Roy, a Post Graduate in Business Management from Indian Institute of Planning & Management, joined the Group as President –

Business Development in August 2017. He has 23 years of experience in Capital Market with core focus on various business operational

functions and also in the field of Telecom & FMCG. Prior to joining the Group, he was associated with Achievers Equities as a Director and

prior to Achievers, he was with Axis Securities, MF Global Sify Securities, ICIC Securities Ltd. and had also been with Airtel and Nestle India.

He also oversees the Administrative, Human Resource, Risk Management related affairs of the Company along with other Business

Operations and managing all associated risks. Shivaji is gifted with excellent operational and client management skills to operate

collaboratively with his team members to achieve a common goal.

CORPORATE STRATEGIES

The strategies of SMIFS revolves around the age-old Legacy, which is built upon Trust and led to Growth

of the company and its associates through “Thought Leadership, Innovation , Efficiency, Revenue”.

Thought Leadership – Under the able guidance of experienced promoters and senior management, the

team at SMIFS provide the support to clients and business associates on a continuous basis,

unparalleled in financial services sector and global in nature.

Innovation – We adopt innovation as and when it comes in the fast changing landscape of securities

business. Creativity and innovation in Research and Advisory, adoption of superior technologies,

investment product developments are key

Efficiency – Improving speed, quality, retention of key members and effective use of resources to deliver

quality services are key focus areas to increase efficiency.

Revenue – Generating more revenue requires us to develop strategic insights about our clients needs

and goals, to elevate and broaden our mutually beneficial relationship and scaling up our contribution

to clients’ businesses.

We continuously strategize to see growth to our high quality people and clients in the long term, as

they are the foundation to the growth of the organization. We instil and promote a culture of

entrepreneurship, reward high performance and motivate to see overall growth in the organization

VALUES AND PRINCIPLES

People

We care about people and the role

of work in their lives. We respect

people as individuals, trusting

them, supporting them, enabling

them to achieve their aims in work

and in life.

We help people develop their

careers through planning, work,

coaching and training.

We recognize everyone’s

contribution to our success – our

staff, our clients and our

candidates. We encourage and

reward achievement.

Knowledge

We share our knowledge, our

expertise and our resources so that

everyone understands what is

important now and what’s

happening next in the world of

work – and knows how best to

respond.

We actively listen and act upon this

information to improve our

relationships, solutions and

services.

Based on our understanding of the

world we actively pursue the

development and adoption of the

best practices worldwide.

Innovation

We lead in the world of work. We

dare to innovate, to pioneer and to

evolve.

We never accept the status quo.

We constantly challenge the norm

to find new and better ways of

doing things.

We thrive on our entrepreneurial

spirit and speed of response; taking

risks, knowing that we will not

always succeed, but never exposing

our clients to risk.

PRODUCTS AND SERVICES

INSTITUTIONAL EQUITIES

RESERACH AND ADVISORY

PORTFOLIO MANAGEMENT

DEPOSITORY AND REPOSITORY

INVESTMENT BANKING

MUTUAL FUNDS/IPO/FPO

ONLINE AND MOBILE TRADING

EQUITY-DERIVATIVES

COMMODITY-DERIVATIVES

CURRENCY-DERIVATIVES

STRUCTURED PRODUCTS

LOAN AGAINST SHARES

MARGIN FUNDING

TAX SAVING INSTRUMENT AND FIXED DEPOSIT

STRENGTHS

❑ Age old seasoned brand with Solid Financial Profile

❑ Superior Execution Capabilities

❑ Broad Based Clientele

❑ Exclusive Foreign Broking Desk

❑ Effective Research Availability

❑ Superior execution capabilities

❑ Comprehensive Infrastructure

RESEARCH TOOL AND PROCESSES

- Research team work on both top down and bottom up approaches to generate

investment ideas which generally are ahead of the time.

- Research team visit plants, meet senior/mid/junior management team, attend

to conference calls, AGMs on a regular basis to update and also track

developments in the companies under coverage or to be covered.

- Having experienced research team supported with stalwarts of the industry as

promoters gives us much needed edge in terms of access to batteries of

management and industry experts. This helps us in finding emerging trends.

- Annual report analysis from every angle including ESG, in-depth financial

modelling, using different techniques of valuations with special focus on cash

flow and access to loads of industry database and Bloomberg are some of our

USPs.

KNOWLEDGE BASED ADVISORY MODEL

Integration of capital market products, with advisory products for a complete outlook

of perfect portfolio advice-with a live portfolio tracker for an effective tracking system.

• At SMIFS, we redefine wealth creation for various life stages through innovative,

systematic and disciplined investment planning together with superior service,

commitment, and focus on consistent high quality.

• We believe delivery of Research & Advisory is more important than just good

research. Market is flooded with entry strategies but it grossly lacks the exit strategy,

particularly for investors who follow fundamental research.

• At SMIFS, we have defined strategies to advise long term investors and short term

traders.

INSTITUTIONAL CLIENT LIST

MUTUAL FUNDS, BANKS & INSURANCE COS

HDFC Mutual Fund

ICICI Prudential Mutual Fund

Sundaram Mutual Fund

Aditya Birla Mutual Fund

IIFL Mutual Fund

Principal Mutual Fund

Quant Mutual Fund

LIC Pension Fund

General Insurance Corporation

United India Insurance

ICICI Bank

South India Bank

Nippon Mutual Fund

Invesco Mutual Fund

DSP Mutual Fund

Edelweiss Mutual Fund

IDBI Mutual Fund

LIC Mutual Fund

Taurus Mutual Fund

SBI General Insurance

National Insurance Corporation

Hornbill Capital Orchid Fund

Punjab National Bank

Axis Bank

FOREIGN INSTITUTIONAL INVESTORS

Jupiter Asset Management

Royal Bank of Scotland

Natwest Bank Plc.

Cresta Fund

Lotus Global Investment.

Teachers Retirement

– Pension Reserves

Asia Invt. Corpn. Mauritius

Kemnay Invt. Fund

Aquarius India Opporn.

UCO Bank

Indian Bank

Indian Overseas Bank

GMO – Group

Commonwealth of Massch.

Mavi Investment

Albula Investment

GGI Fund Ltd.

India Man Fund

APMS Investment

Eriska Investment

LTS Investment

NABARD

Bank of India

Dhanlaxmi Bank

PORTFOLIO MANAGEMENT SERVICES

SEBI REGISTERED PORTFOLIO MANAGER

REGISTRATION No. IMP000004623

MISSION:

To be Reliable Managers to Our Clients Wealth, and deliver higher returns than benchmarks in a Rational,

Intelligent, Scalable and Repeatable manner

PMS INTRODUCTION

We are a SEBI registered Portfolio Manager

• We are in the business of Managing Wealth through PMS

• We have 11 branches (headquarter in Kolkata) and 57000+ active clients.

• Investment decision is taken by a Committee of Core Group with average experience of

~20 years in Stock Market.

Key Members of PMS Committee

❑ Mr Rahul Kayan

❑ Mr Ashwini Kumar Tripathi

❑ Mr. Sharad Avasthi

SMIFS FLAGSHIP PMS PRODUCT

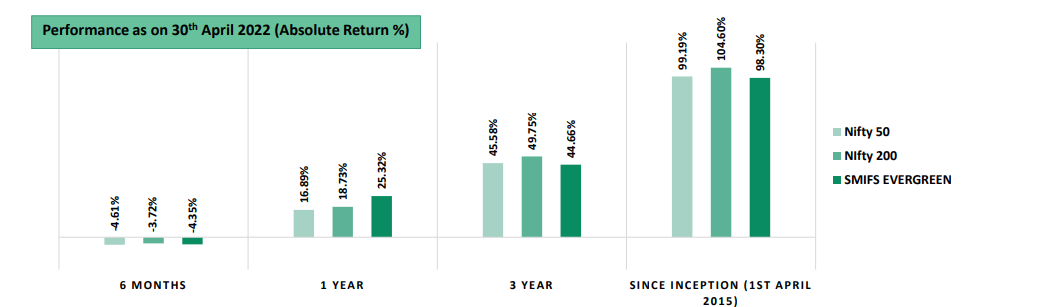

SMIFS Evergreen

- The solid, long term investment product

- The sturdiest, evergreen plant that yield sweet fruits, season after season

- We take tender loving care of these plants, and they become trees.

- Belong to solid gene pool, and give a decent harvest in almost all seasons.

- They can withstand bad weather. These are plants we sow for long term.

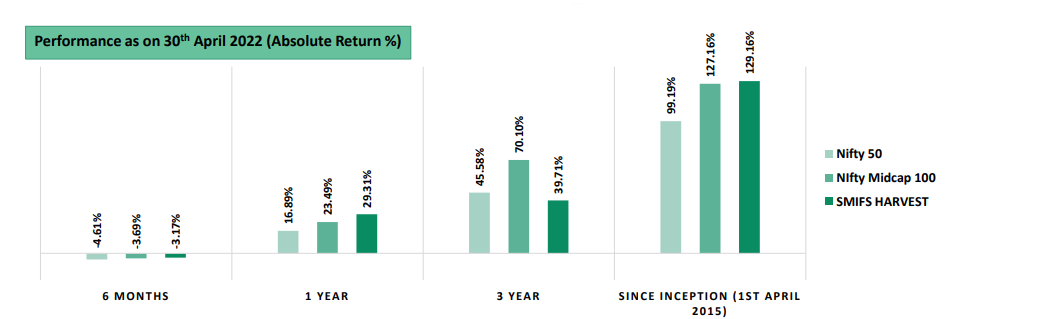

SMIFS Harvest

- Moderate risk, Medium to Long term product.

- For investors who want a slight more aggressive investment approach

- Product offering is driven by the fact some crops grow quicker

- They are also more vulnerable and needs more monitoring

- Reap a larger harvest by planting a few crops in fast growth farm

- Investment call based on risk profile, so that your harvest is larger.

SMIFS EVERGREEN

Our solid, long term investment product is called SMIFS Evergreen. They come from a solid gene pool and give a decent harvest in almost all seasons.

They can withstand bad weather. These are the plants that we sow for the long term.

- Investment Philosophy – Capital Preservation with Solid &

Steady Growth.

- Strategy – Invest in fundamentally strong companies available

at affordable valuation. Invest in large caps and blue chips

- Maximum Weightage – Stock 15% and Sector 25%

- Risk Appetite – Minimal

- Investment timeframe – Long term Holding

- Sectoral Bias – Across the spectrum with no particular bias

SMIFS HARVEST

SMIFS Harvest is our moderate risk portfolio. We recognize that some of our investors want a slightly more aggressive investment philosophy to drive

their investments.

- Investment Philosophy – Take calculated risks and achieve

significant growth

- Strategy – Find clearly identifiable growth stocks at an early stage

so as to ride the surge in value at the right time.

- Maximum Weightage – Stock 20%, Sector 30%

- Risk Appetite – Moderate

- Investment timeframe – Medium to long term, from 6 to 18

months. Expect some churn arising out of investment review.

- Sectoral Bias – Focus on high-growth sectors in India

MODUS AND FEE STRUCTURE

➢ Client/customer signs agreement with PMS manager

➢ A “Portfolio Account” is created

➢ PMS manager operates a “Pool Account” for all clients

➢ PMS manager buys and sells in this pool account

➢ Allocates trades to individual clients’ Portfolio Accounts

➢ Separate slices tracked daily for each client

➢ Dividend, bonus, rights benefit is available to each client

➢ Fees : can be charged on fixed or profit-share basis

FEE STRUCTURE FOR SMIFS PRODUCTS

➢ Under Fixed Plan 2% per annum of the Average Daily Value of the portfolio,

payable quarterly.

➢ Under variable plan A 1% of the portfolio amount plus 10% of the profit above an

annualized return of 10%, payable quarterly.

➢ Under variable plan B, 20% of profit payable Half Yearly

➢ BROKERAGE & STATUTORY CHARGES EXTRA

What If ?

➢ You have some shares already

– We can take either cash or securities (or both) towards your PMS

➢ After we start, you need all the money or a part.

– You can take it back anytime, no restrictions

We need a selling time-window (typically 7 days, else immediate)

➢ You want to infuse fresh/additional corpus

– We take cash and/or securities towards your PMS, anytime

➢ You are unhappy

– We respect your right to be dissatisfied with our services

– You can withdraw your money, no restrictions

Disclaimer

The above presentation is prepared by SMIFS Ltd to show case our Portfolio Management Services. We are a SEBI registered Portfolio Manager and comply with the

guidelines as laid out by the them. The presentation is not a solicitation or an inducement to BUY/SELL/HOLD any securities. The followers of the presentation are advised

to refer to their advisors before making any commitment.

Past performance of our Portfolio Management Services Products are not a guarantee of future performance, hence any decision to start Portfolio Management Services

with SMIFS Ltd. is solely at the discretion /risk of the investor/investors.

SMIFS Ltd, its subsidiaries, or any of its directors, employees, agents, and representatives shall not be liable for any damages whether direct or indirect, incidental, special

or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information, opinions expressed in the above presentation.

Disclosure: Clients/associates of SMIFS Group may be holding positions in equities or their derivatives which are part of the portfolio under various schemes. We ensure

all compliance is adhered to with our portfolio Management Services, this report/reports/opinion or views expressed.