What is a Demat Account? How to open One?

In the world of trading Demat Account just works like how a savings account works in the Banks. Demat accounts makes the investors accessibility towards various trading products easier without any threat of mishandling and theft issues. For stock investment a Demat Account is a top most priority possession for investment in the stock investment and enables the investors to pool shares and financial securities in an electronic form. Depositories like NSDL and CDSL offer FREE Demat Account. SMIFS Limited is a 1993 legacy organization has introduced a paperless and a no-hassle e-KYC process of opening a FREE Demat Account handy with your laptop/PC on our official website www.smifs.com or through our online app SMIFS ELITE available both on android and iOS platform for free download.

You can also refer to our official YouTube channel SMIFS LIMITED and go through the video on how to open a Demat Account: https://www.youtube.com/watch?v=rkl06aabJy8&t=332s (IN HINDI)

https://www.youtube.com/watch?v=i4bfjwHaWHQ (IN BENGALI)

STEPS Involved:

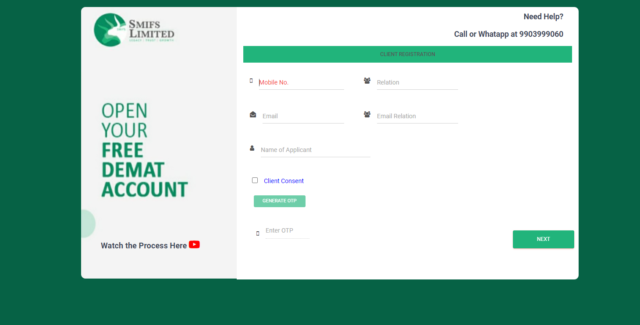

Click on www.smifs.com and choose the option on open an account and now you will be redirected to the client registration page.

Documents to be kept handy:

- PAN Card

- Aadhaar Card

- 10-digit Mobile Number linked with Aadhar

- Personalized Cancel Cheque of your bank

- Photograph

- Scanned Signature

Client Registration Begins:

- Put your 10-digit mobile number linked with your Aadhar

- Enter e-mail which is registered on the given phone number

- Select your email relation from the drop down menu and make a suitable selection

- Enter name of the applicant

- Click on client consent check box

- A pop-up will appear on your screen asking for your consent to pen a Demat Account

- Press ‘OK’ to continue

- Click on GENERATE OTP

- A 6-digit OTP will be sent to you. First 3-digit on the Phone SMS and last 3-digit on the email address set at the time of registration

- Enter the OTP and click ‘NEXT’ to continue

Fill PAN Details

A pop up will appear on the screen regarding all the documents required for completing the e-KYC process before you can start to fill the details

- Enter your PAN number.

- NSDL will confirm you once verified. Click OK in the popup to continue

- Enter your date of birth

- Select the source to open your account (choose DigiLocker for easy access of files)

- Click the checkbox to allow SMIFS to use your given documents for e-KYC

- Enter the last 4 digits of your Aadhar ID and click ‘Fetch from DigiLocker’

- Enter your Mobile/Aadhar number. You can also put your username if you have an existing DigiLocker account and then click on ‘Sign in with OTP’

- Enter the 6-digit OTP received on your phone and click on ‘Continue’

- Enter a PIN that will be the password for your DigiLocker, retype on ‘Confirm PIN’ and click on ‘Submit’

- DGIGILOCKER-SMIFS will ask for your consent to allow this app to access your DigiLocker. Click on ‘Allow’ to continue

- A pop-up will appear on your screen with basic Aadhar details

- Click ‘OK’ to continue

- Click ‘NEXT’ on the PAN details page

Fill PERSONAL DETAILS

- Enter your personal details (mandatory to fill details with * mark on it)

- Enter all the basic details and select ‘Resident Individual’ in the resident status

- Click ‘NEXT’ to go to the next page or click on ‘PREVIOUS’ to make any changes

Fill CORRESPONDANCE ADDRESS

- Enter your address (mandatory to fill details with ‘*’ mark on it)

- Select address type as per preference

- Enter contact details

- Select ‘YES’ if your correspondence address is same as permanent address else select ‘NO’ and click ‘NEXT’

Fill PREMANENT ADDRESS

- Fill your permanent address if your correspondence address differs from permanent address

- Select ‘NO’ if you are a tax resident of India and ‘YES’ if you are a tax resident of any other country except INDIA

- Click ‘NEXT’

Fill TRADING PREFERENCES

- Select your trading preference and the exchange as per your choice

- Select ‘Digital’ as the preferred mode of receiving contract note (sent on your e-mail)

- Select your preferred depository from the dropdown menu

- Click ‘NEXT’

Fill Nomination Details

- Click on ‘YES’ if you want to make a nomination else click ‘NO’

- In case you choose ‘YES’ a set of column will appear asking you to fill-up all the necessary details of your nominee.

- Fill your address and contact details and click ‘NEXT’

- A popup will now appear on your screen top asking if you want to add more nominee. Select ‘YES’ or ‘NO’ as per your preference

- The nominee names and percentage of shareholding will now appear to you

- Click ‘NEXT’ to move forward to the next step

Fill DP Details

- Click on ‘YES’ if you have an existing Demat Account or else choose ‘NO’

- Enter your DP id, DP name and Beneficiary id if you have an existing account

- Select ‘Investor’ for your DP scheme and choose your type

- Upon selecting the DP scheme a PDF file will open regarding the details of your plan

- Press NEXT

NOTE: Since both the Demat and trading account are opened together, you will not be allowed to open a Demat account individually.

Fill VOLUNTARY DECLARATION

- Choose your account settlement

- Click ‘YES’ on the services you want to avail else chose ‘NO’

- The ‘Revocable Authorization for Modification in Trading Account’ is selected as ‘YES’ by default

- The ‘Demat Debit’ and ‘Pledge’ option is selected and locked at ‘NO’ by default. The option ‘YES’ will be enabled on 1st September as per SEBI circular

- Click ‘NEXT’

Fill TREMS AND POLICIES

- Go through all the terms and policies once

- Click ‘NONE OF THE ABOVE’ for Client Special Category

- Click ‘NEXT’

Fill PRIMARY BANK

- Fill your primary bank details you wish to link to your Demat account for trading and investing

- Select ‘YES’ if you want to provide additional details and ‘NO’ if you do not want to provide additional details

- Click ‘NEXT’

Fill ADDITIONAL BANK

- Enter your additional bank account in the vacant fields

- Click ‘Next’

Fill REGULATORY DISCLOSURE

- Select your occupation details and select your annual income from the dropdown

- Fill in your trading experience and the PEP (Politically Exposed Person) status

- Enter details of the introducer if you have any

- Select ‘YES’ if you have any pending action. ‘NO’ if you don’t have any pending action

- Select the checkbox of ‘I accept the Terms and Conditions’

- Click ‘NEXT’

Fill UPLOAD DOCUMENTS

Keep all the following documents asked to fill here ready in your device

- PAN Card

- Personalized Cancel Cheque of Primary Bank

- Correspondence Address Proof

- Latest Signature

- Latest Photo

NOTE: All documents should be sized at not more than15MB

- Begin to fill up all the section with * sign as it is mandatory to fill this

- For the latest photograph column, SMIFS will capture a LIVE picture only for the those who have used the feature of ‘Fill Form Manually’ and not via ‘DigiLocker’. If you are using a laptop it will ask for a permission to use the web cam and in cases of your mobile phone a link will be shared in your registered mobile number and e-mail id to capture your picture

- To upload your document, the file format has to be in .jpg, .png, .jpeg, .bmp, .pdf and .tif extensions

Fill BROKERAGE AND DEPOSIT

- Select your desired brokerage scheme from the drop down menu

- SMIFS also provides you with segments for Intraday, Delivery, Derivatives, Currency and Commodity to go through. As per your convenience you may choose a segment or you may download the chart for later

- Choose your mode of payment form the options available

- In case you have not used the DigiLocker option to update your information on the app and used the option ‘Fill Form Manually’ it is mandatory for you to click in the ‘Please complete the ipv before submitting the form’

- Your application is now set for submission. Click on the ‘SUBMIT’ button to make final submission or you can click on the Review/Edit button in order to make some changes which you wish to make

Fill CLIENT REVIEW

- The Client Review page now shows multiple features which the client has filled in order to register his Demat account with us which are Client Details to Voluntary Declaration filled by the clients

- Below this there will be a light green color message box reading ‘Congratulations!!!A/c registration process is completed, Kindly proceed for IPV’

- In case you have filled your form manually you need to click on the ‘DO IPV’ option in the bottom corner else you can proceed by clicking on the ‘E-SIGN’ option

Fill ESIGNER DETAILS

- All the user details will be filled automatically

- You now need to click in the check box which reads ‘I authorize SMIFS Limited to eSign my KYC form, Proof documents using my Aadhar Number’

- An Aadhar consent popup will appear on the screen click on the ‘I AGREE’ button

- Click on ‘SIGN KRA BY OTP’ option now

- You will now be redirected to NSDL e-Sign page on the web. Click in the check box at the top to authorize NSDL to use your information

- In the VID/Aadhar blank section enter your Aadhar number and click on ‘SEND OTP’

- Enter the 6-digit OTP received in your registered mobile number and click on ‘Verify OTP’

- Now the Esigner page will appear and you are supposed to click on the check box and click on I agree option on the popup that appears

- Click on the ‘SIGN BY OTP’ button

- You will now be redirected to NSDL e-Sign page on the web. Click in the check box at the top to authorize NSDL to use your information

- In the VID/Aadhar blank section enter your Aadhar number and click on ‘SEND OTP’

- Below the blank space there will be a message box which reads the massage ‘Success! otp sent on your registered mobile/email id

- Enter the 6-digit OTP received in your registered mobile number and click on ‘Verify OTP’

- You are all set to start your trading journey from here

SMIFS Limited will send you your Unique Client Code (UCC) through which you can login to our mobile app SMIFS ELITE or our website www.smifs.com to access your Demat Account. You can make the changes in your password later as per your preference.

In case of any further queries please call us on or Whatsaap SMIFS at 9830121215