| Muthoot Microfin Limited operates as a microfinance institution (MFI), specialising in extending micro-loans to female customers primarily for income-generating purposes, with a dedicated focus on rural regions of India. Muthoot’s array of loan products includes group loans for livelihood solutions, encompassing income-generating loans and Pragathi loans—interim loans for working capital and income-generating activities for existing customers. Additionally, the company offers individual loans, life-improvement solutions like mobile phone loans, health and hygiene loans for sanitation improvement, and secured loans in the form of gold loans and Muthoot Small & Growing Business loans. Muthoot is the fifth-largest NBFC-MFI in India in terms of gross loan portfolio as of FY23. It also holds the third-largest position among NBFC-MFIs in South India, being the largest in Kerala in terms of MFI market share. Additionally, Muthoot is a key player in Tamil Nadu, with an almost 16% market share as of FY23. As of September 30, 2023, Muthoot’s gross loan portfolio amounted to INR 108,670.66 million. Muthoot serves 3.19 million active customers through 1,340 branches spread across 339 districts in 18 states and union territories in India as of September 30, 2023. Historically, operations were concentrated in South India; however, recent years have seen significant expansion into North, West, and East India. As of Q3FY23, Muthoot has a total of 707 branches in these regions, constituting 52.76% of its total branches.

Investment Rationale:

MFI industry GLP to grow at 18-22% CAGR between FY23 and FY28:

Muthoot expanding its geographical footprint and sourcing platform across Rural India:

Muthoot Microfin holds the majority market share in Kerala and Tamil Nadu:

Muthoot’s digital focus to reduce risks:

Strong Customer retention:

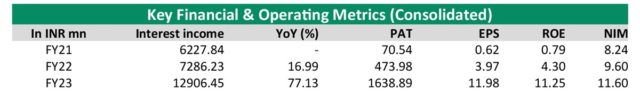

Valuation and outlook: As of September 30, 2023, the gross loan portfolio amounted to INR 108,670.66 million. A well-diversified portfolio across 339 districts in 18 states and union territories in India. The gross loan portfolio in our top three states, namely Kerala, Karnataka and Tamil Nadu, together accounted for 51.36% of our total gross loan portfolio. Collection efficiency was 95.84% and 98.89% for the Financial Year 2023 and the six months ended September 30, 2023, and gross NPA ratio was 2.37% and net NPA ratio was 0.33%, as of September 30, 2023. The capital adequacy ratio of 20.46% as of September 30, 2023, is well above the requirement of 15.00% prescribed by the RBI. The company reported interest income of INR 12906.45 million which grew 77.13% YoY and NIM of 11.60 in FY23. The company’s GNPA and NNPA stood at 2.97% and 0.60% in FY23. At the upper price band, the company’s P/B translates to 1.74x. We recommend subscribing to the issue given the strong long-term potential of growth as well as attractive return ratios and credit costs that the company has managed to maintain over the last few years.

Click here to read the full IPO Note.

|