Projected to surge from 774 tonnes in 2022 to 855 tonnes in 2028, gold demand in India is on an upward trajectory. In the gold jewellery segment, short-term drivers like a low starting point, pent-up demand, and a surge in weddings are expected to fuel demand. Long-term growth, on the other hand, is anticipated to be bolstered by improving economic conditions, urbanization trends, and rising disposable incomes. Motison Jewellers Ltd. is looking to benefit from this growth in this growing demand for gold and diamonds, which is reflected in its FY23 earnings volume growth in gold and diamond sales and is expected to continue in the coming quarters.

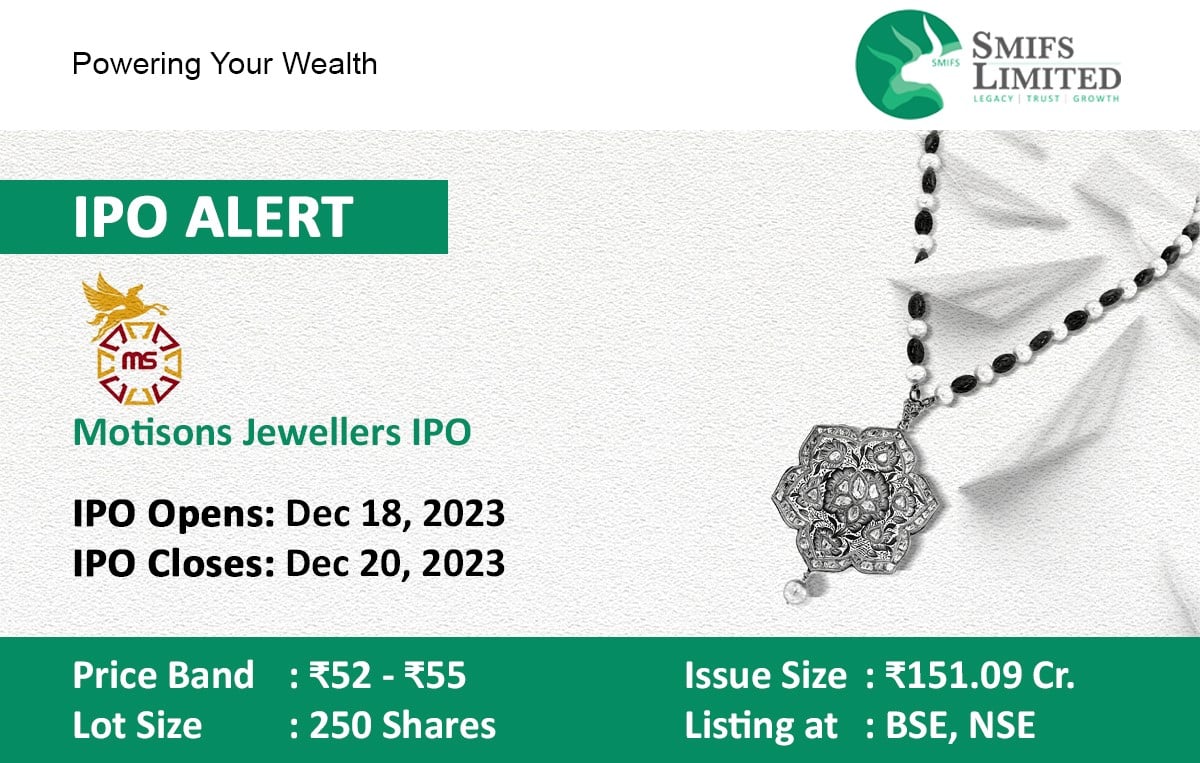

Motison Jewellers Ltd. is a hyperlocal jewellery retail chain in Jaipur, Rajasthan, which has four showrooms, including a flagship outlet. The jewellery business encompasses the sale of gold, diamonds, kundan, and other products such as pearls, silver, platinum, precious and semi-precious stones, and various metals. The extensive product portfolio features over 300,000 jewellery designs, catering to a diverse range of preferences and budgets The company is actively expanding its presence in Jaipur, Rajasthan, to tap into different market segments and align with the varied tastes of the local population. The most recent addition, located in the affluent Vaishali Nagar neighbourhood in the south-western part of Jaipur, Rajasthan, was unveiled in CY21. Motison does not have any holdings or subsidiary companies. In addition to showcasing products at showrooms, Motison has also extended its reach to younger and more digitally savvy customers through its online platform.

The company reported revenues of INR 3661.96 million, which grew 16.50% YoY in FY23. The company’s EBITDA was reported at INR 489.87 million, which grew 28.01% YoY with an EBITDA margin of 12.83% in FY23 compared with 11.37% in FY23. The company’s ROE and ROCE was reported at 17.56% and 16.68%, respectively, in FY23.

Objects of the issue:

1. Repayment of borrowings

2. Funding working capital

You can apply online through our SMIFS ELITE App.