India Shelter Finance Corporation Limited (ISFCL) is a retail-focused affordable housing finance company with an extensive distribution network comprising 203 branches as of Q2FY23 and a scalable technology infrastructure across its business operations and throughout the loan life cycle. Between FY21 and FY23, ISFCL witnessed a two-year CAGR of 40.8% in terms of AUM. The target segment for ISFCL is the self-employed customer, with a focus on first-time home loan takers in the low and middle-income groups in Tier II and Tier III cities in India. ISFCL specializes in affordable housing loans, i.e., loans with a ticket size lower than INR 2.5 million as per the criteria set out in the Refinance Scheme under the Affordable Housing Fund for FY21-22 issued by the National Housing Bank. This strategy helps in generating relatively high yields on advances. For Q2 FY23, ISFCL’s yield to advances was 14.9%, which was the third highest in India for such a period. ISFCL’s credit and risk management policies, backed by technology and data analytics throughout its business processes, help maintain asset quality, leading to GNPA being 1.00% and 2.79% as of Q2FY23 and Q2FY22, respectively.

Investment Rationale:

Steady growth in the Indian housing finance market boosts prospects for companies operating in this segment:

- Despite the constant focus on the housing segment, housing in India is far from adequate. The housing shortage in India has continued to escalate since the estimates made during the Twelfth Five-Year Plan.

- The total incremental demand for housing loans, necessary to address this entire shortage, is estimated to range between INR 50 trillion to INR 60 trillion, according to the Committee report. In contrast, the overall outstanding housing loans (excluding PMAY loans) as of FY23 amount to approximately INR 31.1 trillion.

- This indicates the immense latent potential of the market if concrete action is taken to address the shortage of houses in the country. The Indian housing finance market registered a robust ~13.5% CAGR (growth in loan outstanding) during FY19–23 due to an increase in disposable incomes, strong demand, and an influx of new players into the segment.

Market share of HFCs increased to 34% in overall housing loans in FY23.

- The housing finance sector in India includes Public Sector Banks, Private Sector Banks, Housing Finance Companies, NBFCs, and various other players such as foreign banks and Small Finance Banks. Out of the total housing loan market outstanding at approximately INR 31 trillion, public sector banks held the largest market share at 40% during FY23.

- Housing Finance Companies (HFCs) followed closely, with the second-highest market share of 34%. Among the various players, public sector banks continued to dominate the sector with the highest market share, with HFCs maintaining their position as the second-largest contributor in the segment. Public banks reported the highest market share at 42%.

- However, they have been consistently losing market share to HFCs since fiscal year 2020 in the affordable housing finance market.

ISFCL registered strong growth between FY19 and FY23 amongst compared peers:

- ISFCL had the second-highest CAGR between FY19 and FY23 in terms of AUM (38.7%), trailing only behind Vastu Housing Finance (46.2%).

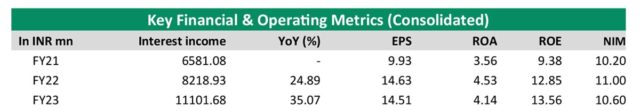

- ISFCL also reported the second-highest total income-to-advance ratio at 16.8%, following Aptus Value Housing Finance (17.1%) as of FY23. During the same period, ISFCL also disclosed the third-highest yield on advances at 14.9%, surpassed by Aptus Value Housing Finance (17.7%) and Shubham Housing Finance (15.6%) among its peers. Additionally, ISFCL reported the third-highest net income to the average of total assets at 10.6%, trailing behind Aptus Value Housing Finance (13.3%) and Vastu Housing Finance (11.3%). ISFCL also has the 3rd highest RoA at end of FY23.

- In FY23, India Shelter Finance Corporation Limited (ISFCL) recorded the second-highest reduction in Gross Non-Performing Assets (GNPA) and held the fourth-lowest pool of restructured assets among its peers. India Shelter’s net non-performing asset (NNPA) also witnessed a decline from 1.60% in FY22 to 0.85% in FY23.

Valuation and Outlook:

We remain positive on ISFCL due to:

i. The total incremental demand for housing loans, necessary to address this entire shortage, is estimated to range between INR 50 trillion and INR 60 trillion.

ii. The market share of HFCs increased to 34% in overall housing loans in FY23, which the companies are winning from public sector banks, which still dominate the sector.

iii. A strong performance against peers with the second-highest AUM growth and third-highest RoA growth in FY23, which is expected to continue in the coming quarters. The company reported revenues of INR 5845.30 million in FY23, which grew 30.48% YoY with an AUM of INR 43,594 million, which grew 41.8% YoY. The company reported an ROA of 4.7%, a 2.4x total borrowings-to-equity ratio, and an ROE of 16.4% in FY23. The company reported a GNPA of 1%, which represented a change of -1.79% YoY and an NNPA of 0.72%, which represented a change of -1.43%. We recommend subscribing to the issue due to the rapid growth that the ISFCL is slated to see in the days ahead, aided by control in GNPA’s, one of the best return ratios, and strong branch and manpower additions. Add to that, at the upper end of the price band, the P/B translates to ~2.4x, which is at a discount to most comparable peers.