Commodity trading through the Multi Commodity Exchange (MCX) in India opens up diverse market possibilities for investors beyond traditional assets. MCX, the Multi Commodity Exchange of India Limited, is a prominent platform for trading a wide range of commodities, including precious metals, energy products, agricultural commodities, and base metals. In this blog, we’ve explored what MCX trading entails, highlighted its advantages, and provided a step-by-step guide on how to trade MCX commodities. Whether you’re looking to diversify your portfolio, hedge against inflation, or capitalize on speculative opportunities, MCX offers a robust platform for commodity trading in the Indian market.

Commodity trading is a fundamental part of the financial world, offering investors the opportunity to participate in various markets beyond stocks and bonds.

The Multi Commodities Exchange (MCX) is a well-known commodities trading platform in India. In this article, we will define MCX trading, explain how it works, and walk you through the process of trading MCX commodities.

What is MCX?

The acronym MCX stands for Multi Commodity Exchange of India Ltd. The Multi Commodity Exchange, situated in Mumbai, was formed in November 2003. Initially, its regulatory control was supplied by the Forward Markets Commission (FMC). However, when FMC merged with SEBI in 2016, regulatory responsibility over MCX was transferred to the Securities and Exchange Board of India (SEBI).

This exchange acts as a digital platform for commodity traders to engage in online trading as well as the clearing and settlement of commodity futures transactions. In essence, MCX provides a straightforward and effective platform for traders to engage in hedging activities.

Analyzing the Top Drivers of Commodity Price Variations in MCX

1. Demand and supply: The balance between supply and demand is the most important factor influencing commodity prices. Periodic oscillations, domestic economic circumstances, and worldwide market patterns all have an impact on demand and supply swings. Prices tend to rise when demand exceeds supply and vice versa.

2. Cost Structure: Commodity prices are heavily influenced by the cost of production. This cost covers expenses for research and development, raw material acquisition, labour wages, taxes, and other operational costs. Variations in these cost variables can have a direct impact on commodity pricing.

3. Geo-political issues: Commodity prices can be significantly influenced by geopolitical events and conditions. Unrest in politics in key commodity-producing regions, for example, may interfere with supply networks and cause volatility in prices. Furthermore, trade conflicts, embargoes, and sanctions can all have an impact on the worldwide flow of commodities, impacting prices in both positive and negative ways.

4. Commodity prices are heavily influenced by advances in technology. Modern technology can increase efficiency in manufacturing, resulting in higher outputs and minimising marginal costs. Advancements in technology can potentially increase supply and decrease production costs, potentially impacting commodity prices.

The Profitable Path: Unveiling the Benefits of MCX Commodities Trading

One of the most important pros of MCX IS its transparency It provides transparency in trading volumes, prices, and changes, allowing traders to make sound choices based on correct information, making it a well-structured and organised platform.

Moreover, the MCX also provides a wide range of opportunities through its multiple monthly derivatives and options contracts. Such opportunities present traders with the necessary variety and liquidity, which can help inhibit risk and boost profitability.

Understanding the Basic steps to initiate MCX Trading

MCX (Multi-Commodity Exchange) trading entails purchasing and selling several commodities. The following are the fundamental stages to getting started with commodity trading on the MCX:

1. Creating a trading account: The first step includes finding a trustworthy brokerage firm that provides MCX trading services. To open a commodity trading account, you need to first contact the chosen broker. Following this, you need to provide the necessary documents, such as identification and address proofs, as well as your PAN card.

2. Completing the KYC procedures: Next, you need to complete the KYC process, which involves providing your Aadhaar card and a passport-sized photograph. After this, your documentation will be verified, and your trading account will be activated by the broker.

3. Funding the trading account: In order to begin trading, you need to deposit funds into your trading account. Your deposit should cover your trading capital as well as your margin obligations. You can electronically transfer money from your bank account to your trading account.

4. Choosing a commodity for trading: MCX allows you to trade a wide variety of commodities. Precious metals, basic metals, energy products, and agricultural commodities are among the categories available. Choose a commodity that fits your trading approach and objectives.

5. Evaluating the market situation: Before initiating a transaction, it is critical to analyze market circumstances and undertake extensive research on the commodity you intend to trade. Commodity prices are affected by factors such as supply and demand, geopolitical events, and macroeconomic indices.

6. Placing an order: In MCX trading, you can utilise a variety of orders, including market orders, limit orders, and stop-loss orders. A market order is executed at the current market price, but a limit order specifies a price at which you wish to purchase or sell. Stop-loss orders are intended to reduce potential losses by automatically selling when the price hits a predetermined threshold.

7. Tracking your position: It is critical to continually track your position once you have placed your transaction. Commodity markets can be extremely unpredictable, with prices altering rapidly. Monitoring enables you to make quick decisions, such as profit or loss.

8. Risk Management: Implement risk management measures to safeguard your wealth. This may entail placing stop-loss orders, diversifying your portfolio, and ensuring you do not risk more capital than you can reasonably afford to lose.

9. Keeping yourself well-informed: Keep up with news and events that may have an impact on commodity prices. Natural disasters, geopolitical tensions, and government policies can all have a substantial impact on commodity prices.

10. Review: Take time after each trade to reflect on your performance and learn from your mistakes. This iterative method might help you fine-tune your trading strategy over time.

MCX trading offers a wide range of options for commodity investors and traders. To effectively participate, open a trading account with a registered broker, undertake extensive research, and employ appropriate risk management procedures. MCX trading, like any trading, has dangers, so educate yourself and build experience gradually.

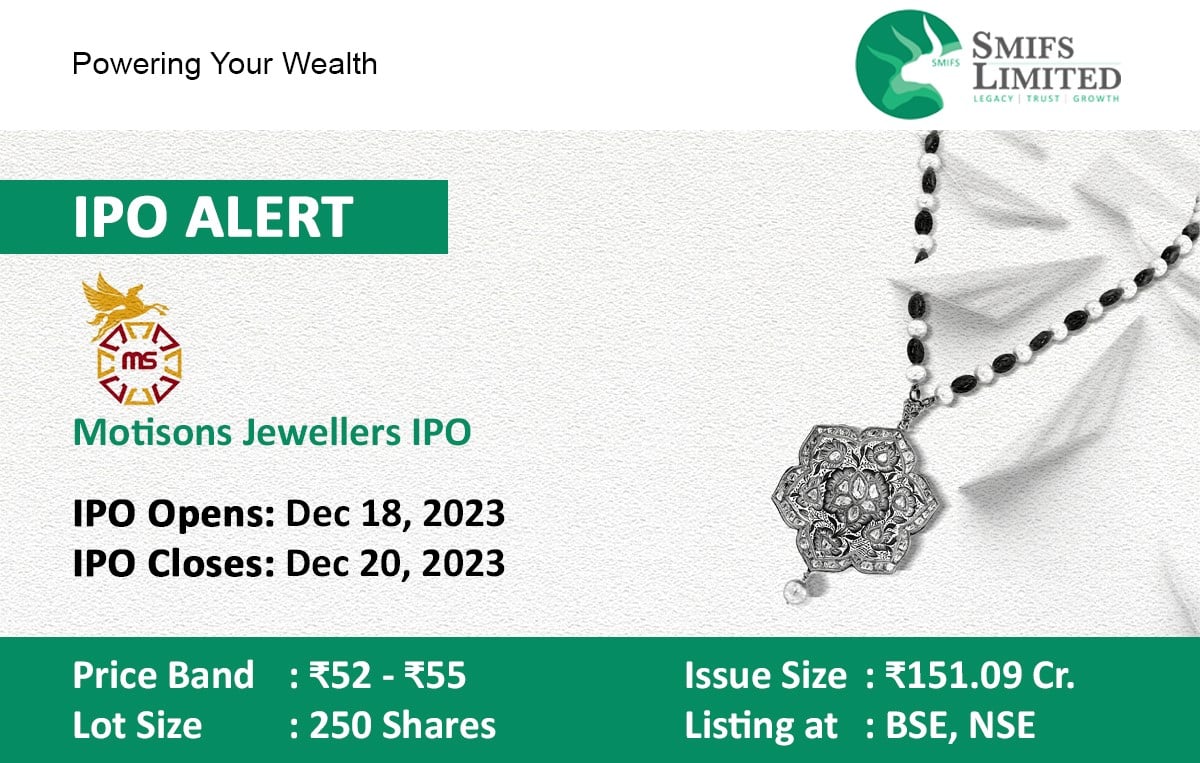

Moreover, commodity trading can be profitable if done correctly and through reputable platforms such as MCX. Commodity exchanges also ensure uniformity and assist investors in understanding the transaction. If you want to begin trading commodities, open a demat account with Smifs today and begin trading as soon as possible.