Flair Writing Industries is among the top three players in the overall writing instruments industry and occupy a decent market share in the overall writing and creative instruments industry in India. The company is also among the top two organized players which have seen faster growth in revenue as compared to overall writing and creative instrument industry growth rate. The company’s products are sold under its “Flair” brand, its principal brands “Hauser” and “Pierre Cardin” and it has also introduced “ZOOX” in India. Its brands “Flair” and “Hauser” offer mass-market and premium pen and stationery products, its brand “ZOOX” focusses on mid-premium and premium writing instruments, and its “Pierre Cardin” brand offers premium pen and stationery products. It also contracts manufacture writing instruments as an OEM for export and for sale in India. It also provides customized corporate gifting products to its corporate customers.

Investment Rationale:

Among the top three players in the overall writing instruments industry in India:

- The company is among the top three players in the overall writing instruments industry with a revenue of INR 9,155.5 million in FY23 and occupy a market share of around 9% in the overall writing and creative instruments industry in India, as of March 31, 2023.

- The company is also among the top two organized players which have seen faster growth in revenue as compared to overall writing and creative instrument industry growth rate, i.e., while the industry grew at a CAGR of 5.5% between FY17 and FY23, Flair grew at a CAGR of around 14% during the same period.

Continue to increase production capacity and enhance capacity utilization:

- As of June 30, 2023, Flair had 11 manufacturing plants situated in Valsad, Gujarat; Naigaon (near Mumbai), Maharashtra; Daman, Union Territory of Dadra and Nagar Haveli and Daman and Diu; and in Dehradun, Uttarakhand. The aim is to consistently rank among the top three players in the overall writing instruments industry in India. The manufacturing plants, excluding the one in Naigaon, Maharashtra, had a combined production capacity of 517.53 million pieces per quarter and 2,023.68 million pieces per annum, as of June 30, 2023, and March 31, 2023, respectively, with capacity utilization of 77.59% and 72.82% in the three months ending June 30, 2023, and FY23, respectively.

- To increase production capacity, INR 559.93 million from the proceeds from the IPO offer will fund capital expenditure to set up a new manufacturing facility in District Valsad, Gujarat by FY26.

Emphasis on Mid-premium Segment and Premium Segmentto increase margins:

- The focus is on increasing the sales of the Mid-premium Segment and Premium Segment products, particularly Flair’s “Flair,” “Hauser,” and “ZOOX” products, priced between INR 20 and INR 100, and Flair’s “Pierre Cardin” products, which are priced INR 100 onwards.

- In FY23 the company has 12 and 59 mid premium and premium products. Such products achieve better margins and improve the shelf visibility of Flair’s products and the positioning of Flair’s brands with consumers.

Largest Pan-India distributor/dealer network:

- The company’s multi-tiered nationwide domestic sales and distribution network enables its products to reach a wide range of consumers and help to ensure effective market penetration across geographies.

- Compared with other key organized players in the writing and creative instruments industry such as DOMS, Camlin, Linc and Luxor, the company had the largest distributor/dealer network and wholesale/retailer network, in the writing instruments segment in India, comprising around 7,700 distributors/dealers and around 315,000 wholesalers/retailers, as of March 31, 2023.

- As of June 30, 2023, it had 131 super-stockists in India (including Flair Sporty), supported by its sales and marketing employees, and a retail presence in 2,424 cities, towns and villages in India.

Strengthening presence in key geographies along with strategically expanding exports:

- Flair has nurtured long-term relationships with international companies, either through manufacturing and distribution or as a contract manufacturer.

- Flair also benefits from adverse exchange rate fluctuations, given that the pricing of its products is typically in USD. There are plans to boost exports of branded products in comparison to OEM products by exploring global markets, including the U.S., through e-commerce sales.

- Additionally, Flair aims to capitalize on the “China Plus One” strategy and position itself as the preferred partner for international brands in the writing instruments industry.

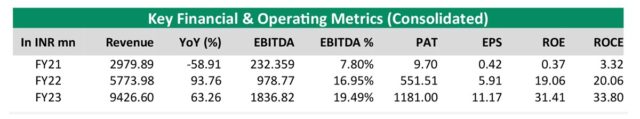

Valuation and Outlook: We remain positive on Flair due to: i. The company is among the top three players in the overall writing instruments industry with a revenue of INR 9,155.5 million in FY23. It occupies a market share of around 9% in the overall writing and creative instruments industry in India, as of March 31, 2023. ii. The company is also among the top two organized players which have seen faster growth in revenue as compared to the overall writing and creative instrument indus-try growth rate, i.e., while the industry grew at a CAGR of 5.5% between FY17 and FY23, Flair grew at a CAGR of around 14% during the same period. iii. Emphasis on mid-premium and premium segment products to improve margins. iv Increasing manufacturing capacity by FY26 will help the company to address the rising demand for writing products. The company’s total income increased by 62.39% to INR 9,542.91 million in FY23 from INR 5,876.42 million in FY22. Moreover, its PAT increased by 114.14% to INR 1,181.00 million in FY23 from INR 551.51 million in FY22. Its ROE and ROCE were reported at 31.41% and 33.80% in FY23 which increased drastically from 19.06% and 20.06% in FY22. With rising capacity and improving capacity utilisation and premiumisation gaining traction, Flair which enjoys a dominant market share should benefit from entering new international markets. At the upper end of the price band, the P/E translates to ~27.21x which is also attractive as the company is valued at a discount to peers inspite of better return ratios and comparable revenue, hence we recommend to subscribe to the issue.

Click here to read the full report