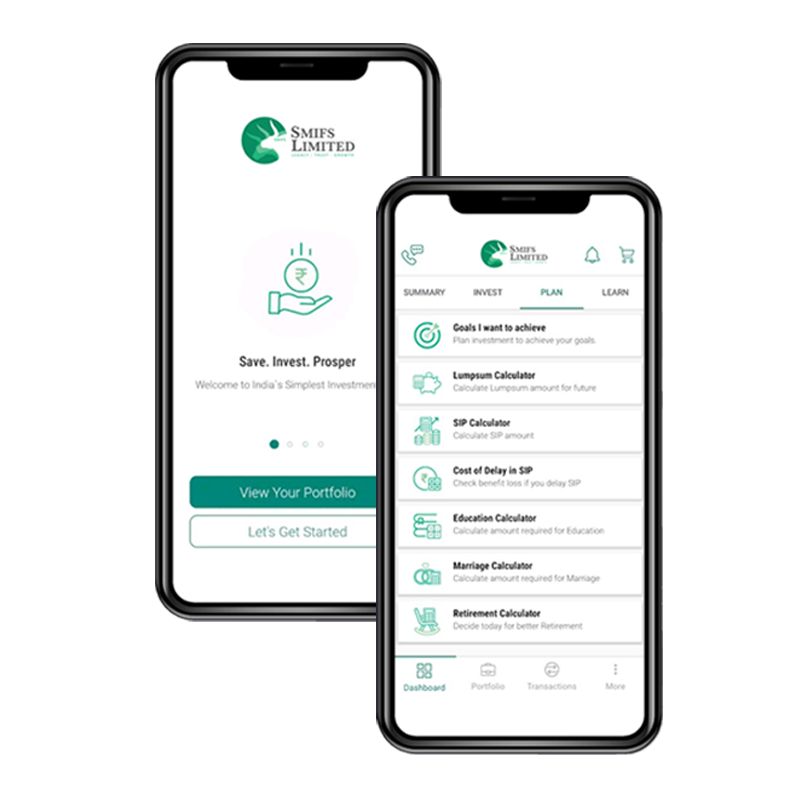

SMIFS Limited caters equity broking services to niche clients, corporate and HNI’s. We are a strong proponent of research-based decision making for equity investments, future trading and options trading. Our Equity sales and dealers are trained to help investors take informed decisions in the derivatives market. Day traders and positional traders are given online and offline technical support to generate alpha returns over a period.

Derivative strategists at SMIFS Limited generally help clients to protect their portfolio through numerous hedging and option strategies. Event-related support is imparted to derivative traders/arbitrageurs which can have direct impact on their returns.

The derivatives trading segment is a highly lucrative market that allows investors to earn superlative profits (or losses) by paying a nominal amount of margin. Over the past few years, the Future & Options segment has emerged as a popular medium for trading in financial markets. Future contracts are available on Equities, Indices, Currency and Commodities. Financial derivatives do away with the need to invest a large amount of capital upfront and allow you to benefit from market movements. This gives you greater liquidity than most other assets. They are an excellent avenue to help you leverage on anticipated market movements and an effective tool to hedge your risks, speculate and earn returns in a relatively shorter duration. You can trade in Futures – contracts or an agreement between two parties to either buy or sell a fixed quantity of assets at a particular time in future trading for a fixed price OR Options – A similar contract, except the parties are not obligated to fulfil the terms of the agreement. These contracts are then traded in the market. Derivatives are also very efficient risk management instruments offering benefits such as:

- Enables you to get higher trading exposure with a low margin amount

- Allows you to safeguard yourself against potential losses, by hedging your positions. As a part of this, you buy in the cash segment and agree to sell in the derivatives market or vice versa

- Allows you to choose between conservative or high-risk strategies based on the expected rise and fall of stock prices

- Possibility to garner returns irrespective of market moving up, down or sideways

SMIFS Limited with its membership as a Trading Member of NSE and BSE in Derivatives Segment provides you with a gateway to the exciting world of the derivatives market. Our experienced trading consultants and advanced trading tools will provide the support you need to achieve your long-term and medium terms profits via the stock markets. Whether you are an active trader who believes in making the most of market opportunities or a new trader seeking information on futures, options trading and derivatives market, our dedicated research and advisory team is well equipped to keep you informed and well-timed on price movement. Our unique range of customized products, are designed to help you leverage your intraday and long term positions.

Stay Prepared and Invest Now.

Helpline (Call 0r WhatsApp) : 9830121215