EMS Ltd. is in the business of Sewerage solution provider, Water supply system, Water and waste treatment plants, Electrical transmission and distribution, Road and allied works, Operation and maintenance of Wastewater scheme projects (WWSPs) and Water supply scheme projects (WSSPs) for government authorities. WWSPs include Sewage Treatment Plants (STPs) along with Sewage Network Schemes and Common Effluent Treatment Plants (CETPs) and WSSPs include Water Treatment Plants (WTPs) along with pumping stations and laying of pipelines for the supply of water. The Company bids for tenders issued by CPWD, State Governments and Urban Local Bodies (ULBs) for developing WWSPs and WSSPs on EPC or HAM basis. EMS has a team of 61 engineers who are supported by third-party consultants and industry experts to ensure compliance and quality standards laid down by the industry and government agencies and departments. As of July 31, 2023, EMS is operating and maintaining 18 projects including WWSPs, WSSPs, STPs and HAM aggregating INR 1744.92 crores and 5 O&M projects aggregating INR 99.28 crores.

Investment rationale:

Capitalize on Government policy initiatives in WWTP and WSSP sectors:

- India is the world’s second most populous country with 1.38 billion people. Out of this, 65% of the population lives in rural area and 35% are connected to the urban centers according to United Nations.

- It is expected that by 2050, about 1450 km of water will be required out of which ~75% will be used in agriculture, ~7% for drinking water, ~4% in industries, and ~9% for energy generation.

- The government is taking certain key initiatives like Jawaharlal Nehru National Urban Renewal Mission, Namami Gange program, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Swachh Bharat Mission (Urban) and Jal Jeevan Mission. Currently EMS operates 5 projects under Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Project under Namami Gange Program. The company is further looking to develop new projects under various government schemes.

Robust Order Book:

- As on July 31, 2023, the company is operating and maintaining 18 projects including WWSPs, WSSPs, STPs & HAM aggregating of INR 1,744.92 crores and 5 O&M projects aggregating to INR 99.28 crores.

- Consistent growth in its Order Book has materialized due to its continued focus to successfully bid and win new projects.

Expansion of footprint:

- EMS has successfully completed 67 projects as on July 31, 2023 across states of Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, Haryana.

- The company gradually intend to expand its business operations to other regions of the country, especially North-East and South India. EMS plans to continue its strategy of diversifying and expanding its presence in these regions for the growth of business.

Scalable and asset light business model supported by its strong financial position:

- The company’s business model relies on the strength of its brand, project execution and management capabilities as well as its well-established relationships with its clients, architects and contractors.

- EMS’s asset-light business model results in efficient utilization of capital resulting in lower debt, allowing them to have higher ROCE. For example, as on March 31, 2023, EMS has a total borrowing of INR 45 crores for the HAM Project of Mirzapur Ghazipur. Apart from this the company does not have any borrowings despite having a huge working capital requirement.

World Bank Funded Projects help in maintaining robust cash flows, timely payments and no bad debts:

- India has 18 percent of the world’s population, but only 4 percent of its water resources, making it among the most water-stressed in the world. A large number of Indians face high to extreme water stress, according to the NITI Aayog.

- Over the last decade, the World Bank has supported the government’s efforts to bring clean drinking water to rural communities. A range of projects with a total financing of $1.2 billion have benefitted over 20 million people. Almost all of EMS’s projects are world bank funded through local state government bodies. This is the main reason of its robust cash flows and timely payments, no bad debts, which helps to take more projects with the help of internal accruals only and helps the company to save finance cost and to increase profit margins.

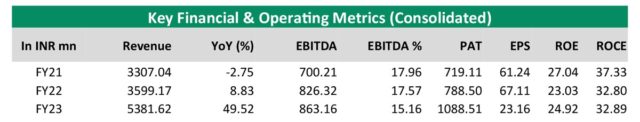

Valuation and Views: EMS is looking to benefit from: i. Strong support from government and world bank initiatives. ii. Expansion of footprint in north-east and south India. iii. EMS’s asset light business model is resulting in higher ROCE. iv. Robust orderbook. The company’s revenue from operations increased 49.55% YoY to INR 538.16 crores for FY23. The company’s PAT for the year increased by 37.66% YoY to INR 10,881.63 crores for FY23 compared. EMS’s ROE and ROCE were reported at 24.92% and 32.89% in FY23 compared to 23.03% and 32.80% in FY22. At upper end of the price band, the P/E translates to ~10.76x on FY23 EPS of INR 19.60. We believe the company has scope to grow ~25% p.a. given EMS’s growth is aligned with government and world bank initiatives to water management and growing population and expansion of footprint with robust order book in hand.

You can read the EMS Limited IPO Note.