SMIFS Portfolio Management Services have been registered with SEBI and is headquartered at Kolkata. An investor’s investment portfolio is a collection of financial assets that may include bonds, equities, currencies, cash and currency equivalents, and commodities. Furthermore, it refers to a group of investments that an investor employs to produce a return while ensuring the preservation of capital or assets. Such an investment depends on an individual’s annual income, time frame, budget, etc. SMIFS has been successful in managing portfolios for the last 30 years and providing long-term investment strategies to its clients.

What do you mean by Portfolio Management Services?

Portfolio management Services is the art of establishing the best investment policy for a person in terms of least risk and greatest return. Portfolio management is the process of managing an individual’s investments in the form of bonds, stocks, cash, mutual funds, and so on in order to maximize earnings within the time-frame specified.

Portfolio management Services is the process of managing an individual’s money under the expert supervision of portfolio managers. Portfolio management is the skill of managing an individual’s investments in layman’s terms.

What are the SMIFS Portfolio Management Services?

At SMIFS PMS the focus is on developing value-based investment ideas with a medium to long-term horizon in order to produce alpha returns. We hunt for “bargains,” or stocks trading at a discount to their normal price. We use a fundamentals-driven strategy to find companies that might potentially be contrarian buys. Strategies at SMIFS PMS are a mix of value and growth approaches.

In volatile times, markets, can be short-sighted and neglect long-term value development. Investing in these times pays handsomely. We favor a disciplined approach to portfolio construction by investing prudently, avoiding excesses and benefitting from crashes.

What is the need for Portfolio Management Services?

There are several reasons as to why we need Portfolio Management Services. These include:

- Portfolio management recommends the optimum investment strategy for each individual based on their income, budget, age, and risk tolerance.

- Portfolio management reduces the risks associated with investment while simultaneously increasing the likelihood of return.

- Portfolio managers understand their clients’ financial requirements and recommend the best and most distinctive investment policy for them, with the least amount of risk associated.

- Portfolio management enables portfolio managers to give customers with tailored investment solutions based on their needs and requirements.

Types of Portfolio Management Services

Portfolio management is further classified as follows:

1.Active Portfolio Management: As the name implies, portfolio managers in an active portfolio management service are actively involved in the purchasing and selling of securities to assure maximum returns to people.

2. Passive Portfolio Management: A passive portfolio manager works with a set portfolio that is designed to meet the current market environment.

3. Discretionary portfolio management services: In this service, an individual allows a portfolio manager to handle his financial needs on his behalf. The person gives money to the portfolio manager, who handles all of his investing needs, including paper work, paperwork, and filing. In discretionary portfolio management, the portfolio manager has the authority to make choices on behalf of his client.

4. Non-Discretionary Portfolio Management Services: In non-discretionary portfolio management services, the portfolio manager can only advise the client on what is good and bad for him, but the customer retains complete discretion.

Fee Structure for SMIFS Portfolio Management Services

- Under Fixed Plan, 2% of the portfolio’s annual average daily value (to be paid quarterly).

- Within the variable plan A, 1% of the portfolio’s value plus 10% of any profits received over an annualized return (to be paid quarterly).

- 20% of profits under variable plan B (due half yearly).

- Advanced Brokerage and Stautary Charges

SMIFS Portfolio Management Services Products

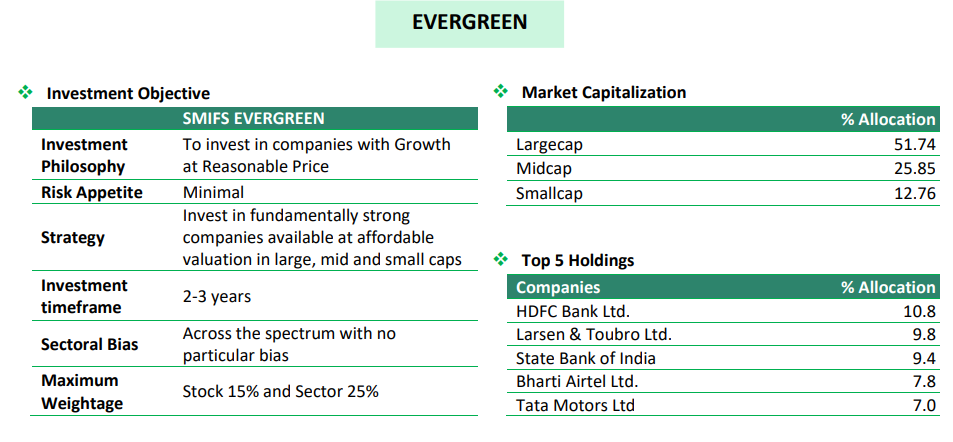

1. SMIFS EVERGEREEN

Report as of 18th August,2022

SMIFS EVERGREEN is a reliable, long term investment product. It picks the exclusive and resilient evergreen plants that consistently produce sweet fruits. It also gives these plants a gentle caring and help them grow into trees. Originated from a good gene pool, SMIFS EVERGREEN produces a satisfactory crop in practically all seasons. In fact, it is weather-resistant and sow the seeds for long term planning.

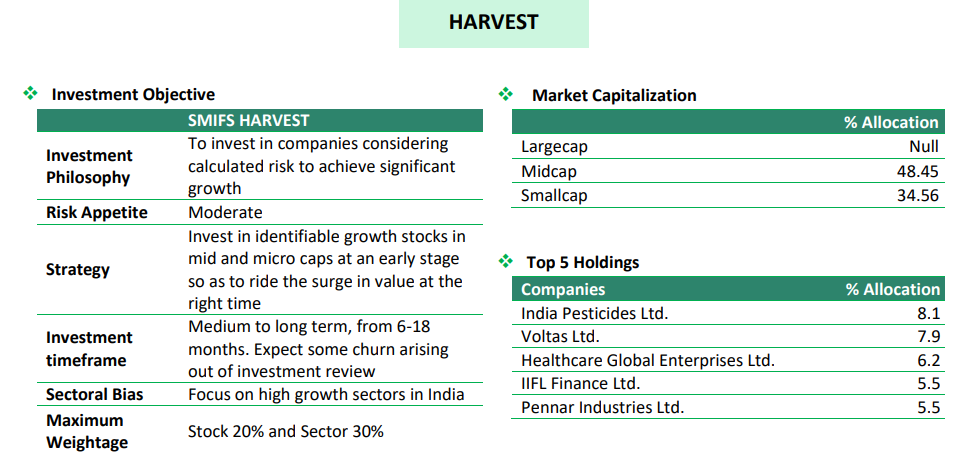

2. SMIFS HARVEST

The other product of SMIFS is SMIFS HARVEST, is a moderately low risk portfolio.

Report as of 18th August, 2022

SMIFS is well aware that some investors like to choose an investment philosophy that is a little bit more aggressive. The fact that some crops grow more quickly than others is what inspired this product line. They frequently require extra supervision since they are more fragile. Depending on the risk tolerance, it is believed that it could benefit investors greatly by growing a few crops in the rapidly expanding farm as well as increase the size of the harvest.

Contact us and start investing in Portfolio Management Services today! Open your free Demat Account now. Contact us at 9830121215 or mail us at dm@smifs.co.in.