Retail Market in India was valued at INR 36,880 Bn (USD 461 Bn) in FY 2015 and reached a value of INR 59,680 Bn (USD 746 Bn) in FY 2020, growing at a 10.1% CAGR over this period. The market was valued at INR 76,080 Bn (USD 951 Bn) in FY 2023 and is projected to grow at a CAGR of 10.4% to reach INR 1,13,360 Bn (USD 1,418 Bn) by FY 2027. The share of Apparel & Accessories in overall retail is expected to reach 9.4% in 2027 from 7.2% in FY 2023, and 6.1% in FY 2022. Apparel and Accessories is also expected to be the fastest-growing sector in the retail basket, with an estimated CAGR of 20.8% from FY 2023-27. While organized retail, primarily brick & mortar, has been in India for 2 decades now, its contribution to total retail was low at 12.2% (INR 7280 Bn) in FY 2020 and 15.7% (INR 12,000 Bn) in FY 2023. The organized retail penetration is expected to increase to ~23% by FY 2027.

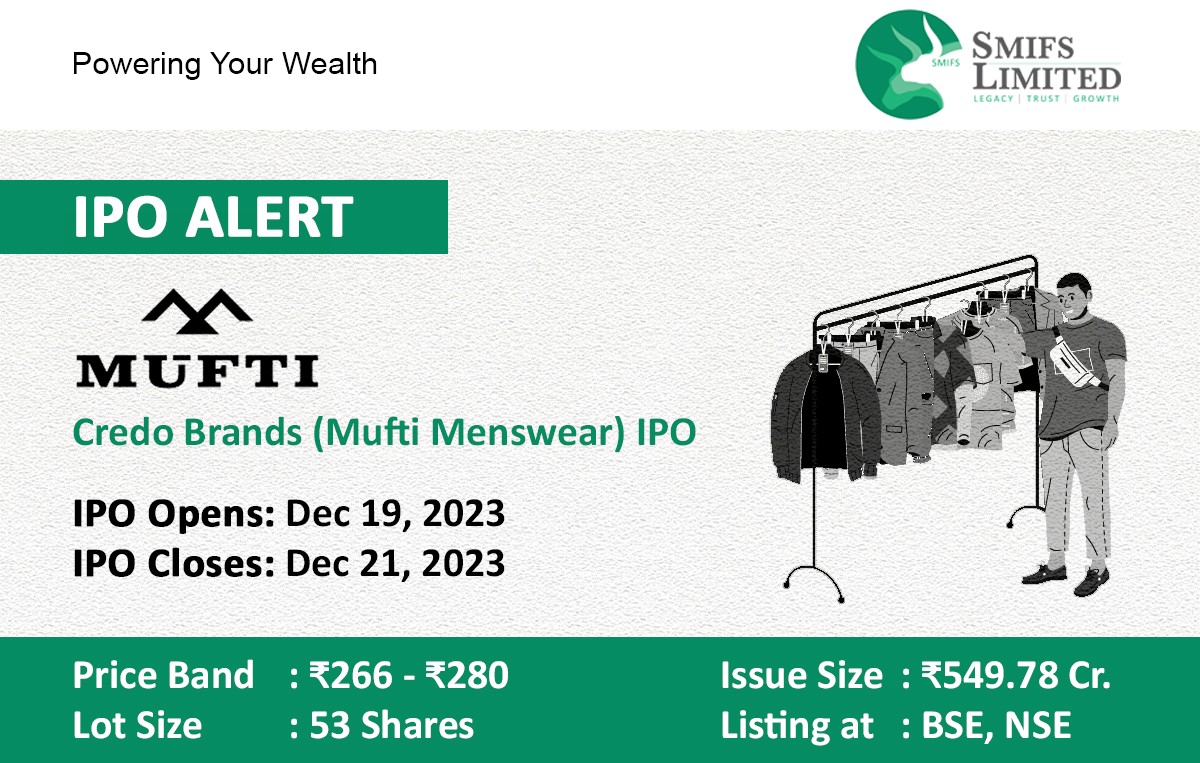

Launched in 1998, the brand “Mufti” is a recognised brand with 25 years of presence in India. Mufti seems like the perfect brand for the young, trendy, and unshackled Indian. The product mix has evolved significantly over the past several years, from consisting of only shirts and trousers in 1998 to a wide range of products including t-shirts, sweatshirts, jeans, cargos, chinos, jackets, blazers, and sweaters in relaxed holiday casuals, authentic daily casuals, urban casuals, party wear, and also athleisure categories. The diverse product range falls under the mid-premium to premium price range of clothing in India.

Revenue from operations grew by 46.02% from INR 3,411.72 million in Fiscal 2022 to INR 4,981.82 million in Fiscal 2023. Credo Brands Marketing Ltd. registered the highest EBITDA margin of 32.89% in FY 2023 among the players available. Credo Brands Marketing Ltd. had a double-digit ROCE of 17.31% for FY 2022 and 28.16% in FY 2023 and an ROE of 16.80% and 30.14% during the same period.

Objects of the issue:

1. Listing benefits in stock exchange

2. Carry out OFS