The global school’s (scholastic) stationery product market was valued at USD 61 billion in CY 22. The market is expected to grow at a CAGR of 2.2% during the period from CY 22 to CY 27 and is expected to reach approximately USD 68 billion by CY 27. The Indian stationery and art materials market has exhibited continuous growth over the years, with an estimated size of INR 38,500 crore by value as of FY 23. The Indian stationery and art materials market is expected to grow at a CAGR of ~13% during FY 23–28 to reach a market value of INR 71,600 crore by FY 28. The growth of this market can be attributed to factors such as the increasing population, education rate, government policies towards education, and evolving digitalization trends that has aided in the growth of the conventional stationery and art materials industry, as students are now spending more time self-studying, drawing, colouring, and doing other hands-on activities. India has a thriving stationery and art materials industry, and there are several opportunities for the country to become an export hub for stationery products. The Indian stationery and art materials export market is expected to grow at a CAGR of ~6% during the FY 23–28 period to reach a market value of INR 7,500 crore by FY 28.

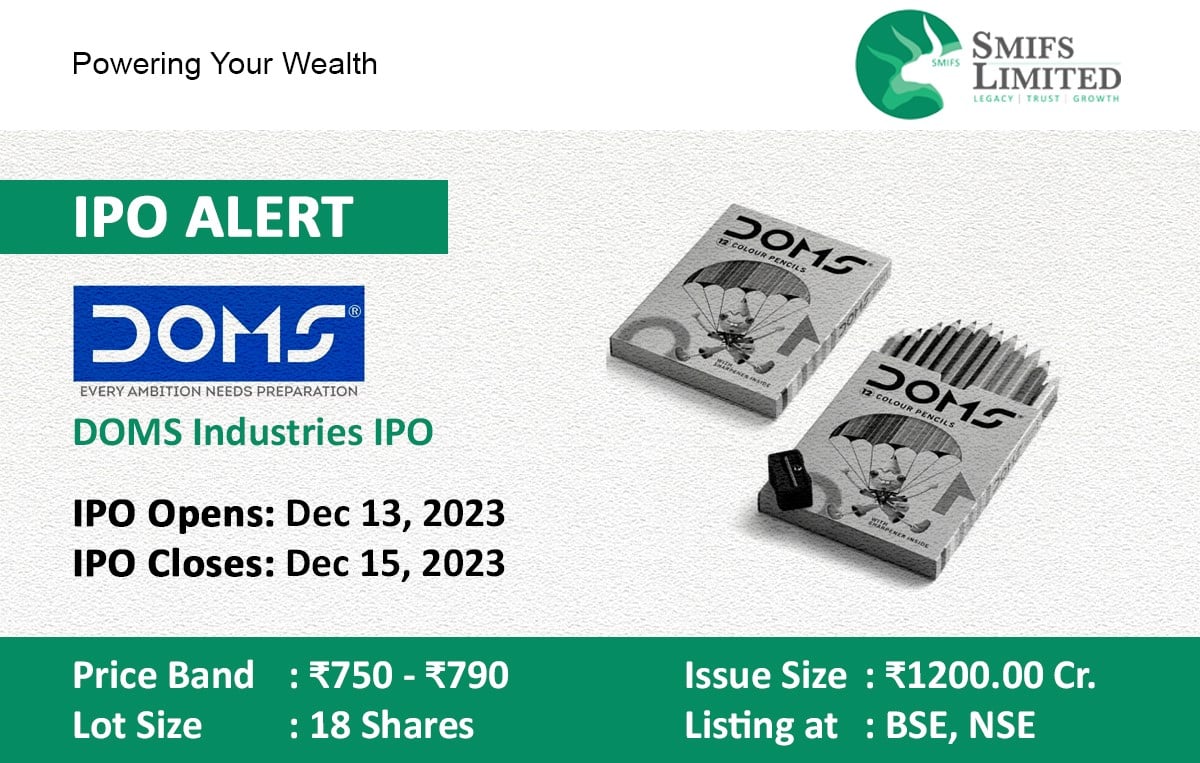

DOMs Industries Ltd. designs, develops, manufactures, and sells a wide range of stationery and art products, primarily under its flagship brand ‘DOMS’, in the domestic market as well as in over 45 countries internationally, as of September 30, 2023. DOM is the second-largest player in India’s branded ‘stationery and art’ products market, with a market share of ~12% by value, as of FY23. DOM’s core products such as ‘pencils’ and ‘mathematical instrument boxes’ enjoy high market shares; 29% and 30% market share by value in FY23, respectively. DOM offers well-designed and quality ‘stationery and art material’ products to consumers, which are classified across seven categories: (i) scholastic stationery; (ii) scholastic art material; (iii) paper stationery; (iv) kits and combos; (v) office supplies; (vi) hobby and craft; and (vii) fine art products.

The company reported revenue growth of 77.28% YoY in FY23 to INR 12118.90 million. DOMS EBITDA grew a massive 164.45% YoY in FY23 to INR 1866.59 million. The company’s ROE and ROCE was reported at 35.19% and 39.15% in FY23.

Objects of the issue:

i. Proposing to contribute to building a new facility for expanded production.

ii. General Corporate purposes.

Click here to read the IPO Note in detail.

[Please Note: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.]