RR Kabel is the fastest growing consumer electrical company among peers with an operating history of over 20 years in India. The company owns and operates two integrated manufacturing facilities which are located at Waghodia, Gujarat, the Waghodia Facility, and Silvassa, Dadra and Nagar Haveli and Daman and Diu (Silvassa Facility) in India, which primarily carry out manufacturing operations in respect of wire and cables and switches. Additionally, the company owns and operates three integrated manufacturing facilities which are located at Roorkee, Uttarakhand (Roorkee Facility), Bengaluru, Karnataka (Bengaluru Facility) and Gagret, Himachal Pradesh (Gagret Facility) in India, which carry out manufacturing operations in respect of FMEG products. Its Waghodia Facility is one of the largest consumer electrical manufacturing facilities in India as of March 31, 2023, with an annual manufacturing capacity of 2.1 million CKM of wires and cables.

Investment Rationale:

Increasing market share in the W&C Segment:

- Nearly 72% of the wires and cables market in India is controlled by branded play. Within this 72%, five leading players namely Polycab, KEI, Havells, RR Kabel and Finolex, garner approximately 60%-62% market share and the balance 38%-40% is controlled by challenger brands like Syska and V-Guard. Polycab is the market leader having approximately 16% market share by value, followed by KEI (approximately 8% market share), Havells (approximately 8% market share), Finolex (approximately 6% market share) and RR Kabel (approximately 5% market share).

- RR Kabel is the fifth largest player in the branded wires and cables market in India, representing approximately 7% market share by value, as of FY23, as compared to approximately 5% market share by value as of FY15. RR Kabel’s share in the domestic W&C market has increased from 3% in FY15 to 5% in FY23.

Government Initiatives boosting growth in the W&C and FMEG segment:

- Key government initiatives are expected to boost the growth for W&C segment thus impacting RR Kabel’s growth directly.

- As a result, we expect the consumer electrical industry consisting of W&C and FMEGs which was estimated at approximately INR 1,81,150 crores in Fiscal 2023 is expected to grow at a CAGR of approximately 10% till Fiscal 2027 to reach a market value of approximately INR 2,66,500 crores. The W&C market constitutes approximately 41% of the Indian W&C and FMEG industry. It has grown at a CAGR of approximately 11% from INR 33,500 crore in FY15 to INR 74,800 crore in FY23 and is further expected to grow at a CAGR of approximately 13% till Fiscal 2027 to reach a market value of INR 1,20,000 crores.

- In Wires and Cables segment, TAM for leading brands like RR Kabel, Polycab, KEI etc. is approximately INR 53,860 crores as of FY23, which is projected to reach approximately INR 96,000 crores by FY27.

China+1 strategy to bring new business to RR Kabel:

- We believe that this China+1 strategy presents a great opportunity for India because of its large manufacturing base, favourable factors of production, strong business ecosystem, and incentivizing government policies, which in turn, is expected to help in growing the export market of Indian W&C industry.

- Leading players like RR Kabel are well-positioned to benefit from the global shift away from China-based manufacturing to China+1 strategy resulting in a share gain for Indian manufacturers in the global market.

Technologically advanced and integrated precision manufacturing facilities:

- The company owns and operates five integrated manufacturing facilities – Waghodia Facility, Silvassa Facility, Roorkee Facility, Bengaluru Facility and Gagret Facility, each located in India. These facilities are accredited to Indian and international standards, capable of precision manufacturing of its range of products.

- Its Waghodia Facility is one of the largest consumer electrical manufacturing facilities in India as of March 31, 2023, with an annual manufacturing capacity of 2.1 million CKM of wires and cables.

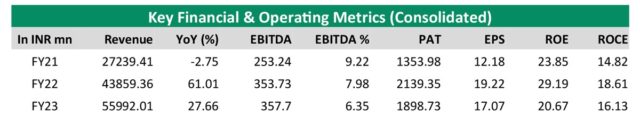

Valuation and views: RR Kabel is looking to benefit from: i. Increasing market share in the Indian W&C and FMEG segment. ii. Key government initiatives to boost growth in the market. iii. China+1 strategy to bring new business to the company. iv. Largest consumer electrical manufacturing facilities in India. V. Fastest Growing Consumer Electrical Company among peers in India with a revenue CAGR of 43.4%. The company’s total income increased by 27.11% to INR 56,33.64 crores for FY23 from INR 4,432.22 crores for FY22. However, the company’s profit for the year decreased by 11.25% to INR 189.87 crores for FY23 from INR 213.94 crores for FY22. RR Kabel’s ROE and ROCE were reported at 20.67% and 16.19% in FY23 compared to 29.19% and 18.61% in FY22. At the upper end of the price band, the P/E translates to ~54.47x on FY23 EPS of INR 19.49. We believe the company has scope to grow ~25% p.a. given RR Kabel’s growth is aligned with government initiatives, growing EV demand and China+1 strategy.

You can read the official R R Kabel Limited IPO Note.