Assume you are setting out on an exciting journey within the realm of financial markets, but you are unfamiliar with the terrain. Having an experienced guide by your side to lead the way and assist you with every step would be comforting, wouldn’t it? A full-service stock broker provides just that. Let’s explore the many advantages of working with a full-service stock broker and see why they can be the ideal ally for your financial endeavors.

What is a Full-Service Stock Broker?

Let’s start with the fundamentals before delving into the benefit of working with a full-service stock broker. A professional who offers full-service stock brokerage is one who offers a wide range of financial services. Full-service brokers provide a range of services, such as financial planning, research, portfolio management, and individualized investment advice, in contrast to discount brokers, who primarily execute trades. They are there to assist you with every facet of investing, much like your own personal financial counselor.

Benefits of using a full-service stock broker

1. Personalized Investment Advice

Personalized investing advice is one of the best features of working with a full-service stock broker. Imagine working with a financial advisor who takes the time to learn about your particular investing preferences, risk tolerance, and financial goals. This customized approach guarantees that your investing strategy is precisely in line with your goals. Whether you’re trying to increase your wealth, save for a big purchase, or retire, a full-service stock broker develops plans that are tailored to your requirements.

2. Comprehensive Financial Planning

The capacity of a full-service stock broker to provide thorough financial planning is another important advantage. Full-service brokers consider all aspects of your finances, not simply the buying and selling of stocks. They make sure that every facet of your financial life is taken care of by offering assistance with retirement planning, tax preparation, and estate planning. Using a holistic approach can be very beneficial because it combines several aspects of your financial strategy into a well-thought-out plan.

3. Expert Research and Analysis

An essential component of making wise investing decisions is conducting high-quality research and analysis. Utilizing a full-service stock broker has several advantages, such as having access to thorough market analysis and top-notch research. Teams of analysts at full-service brokers usually offer comprehensive reports and insights on economic indicators, specific equities, and market movements. You may remain ahead of market developments and make informed judgments with the aid of our study.

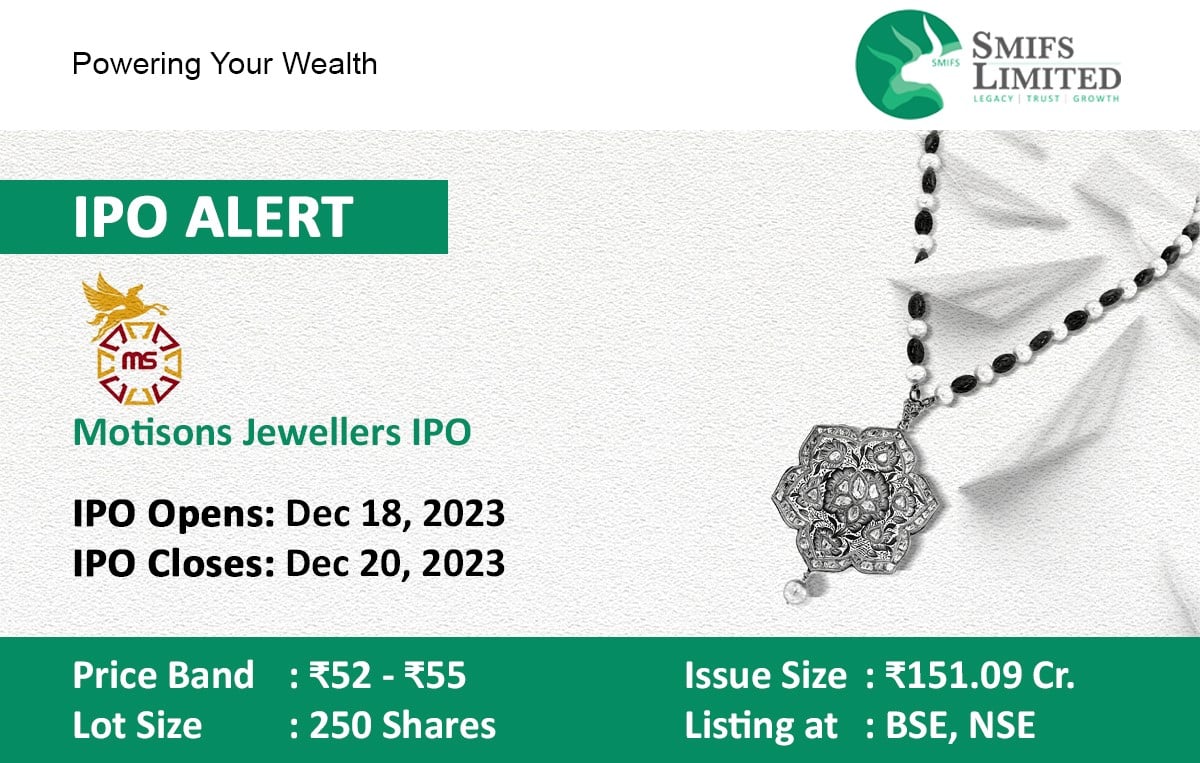

4. Access to Exclusive Investment Opportunities

Specialized investment options that may not be accessible to the general public are frequently made available through full-service brokers. Private placements, IPOs, and high-net-worth investment alternatives are a few examples of these. These exceptional possibilities, which may provide greater profits and portfolio diversification, are among the many advantages of working with a full-service stock broker.

5. Risk Management and Diversification

Successful investing requires careful risk management and diversification, and working with a full-service stock broker has several advantages in these areas. Your portfolio is examined by full-service brokers to make sure it is appropriately diversified across a range of industries, asset classes, and geographic areas. Additionally, they put risk management techniques into practice to shield your investments from severe losses. This expert error contributes to long-term financial success by balancing risk and reward.

6. Continuous Monitoring and Rebalancing

Investing is not something you do once and then forget about. Utilizing a full-service stock broker has several advantages, such as ongoing portfolio rebalancing and monitoring. Your investments are routinely reviewed by full-service brokers to make sure they still meet your financial objectives. They adapt as necessary in response to modifications in the market or changes in your own situation. Over time, this proactive strategy aids in preserving the performance and overall health of your portfolio.

7. Dedicated Customer Support

Among the numerous advantages of working with a full-service stock broker is their outstanding customer support. Generally, full-service brokers provide committed assistance to handle your questions and issues. A full-service broker may aid with transactions, answer inquiries about investing plans, and help with account problems. They can also offer quick, individualized support. You will never be alone on your investment journey with this level of assistance.

8. Education and Guidance

While it might be difficult to understand the complexity of investing, employing a full-service stock broker has advantages such as access to advice and instructional materials. To assist you in comprehending market trends, investing methods, and financial planning principles, full-service brokers frequently provide seminars, webinars, and instructional materials. This instructional help improves your general knowledge of investments and gives you the ability to make more educated decisions.

9. Holistic Wealth Management

Full-service brokers are wealth managers who take into account every facet of your financial life, not just the stock market. One of the advantages of working with a full-service stock broker is that they may combine investment management with other financial services, such insurance, estate planning, and tax preparation. This all-encompassing strategy guarantees that your wealth is managed thoroughly, taking care of your short- and long-term financial requirements.

10. Peace of Mind

Ultimately, peace of mind is one of the biggest advantages of working with a full-service stock broker. The stress and complexity of investing can be removed from you by knowing that a professional is actively managing your portfolio, handling your investments, and giving you competent advice. This peace of mind allows you to focus on other aspects of your life, secure in the knowledge that your financial future is in capable hands.

Conclusion

Using a full-service stock broker has several different perks that might improve your investing experience. These benefits are numerous and varied. Full-service brokers offer more than just transactions; they also give professional research, exclusive opportunities, personalized guidance and comprehensive financial planning. Selecting a full-service stock broker gives you access to a group of experts committed to assisting you in managing risk, reaching your financial objectives, and navigating the intricacies of the investing world. Thus, take into account the many advantages of working with a full-service stock broker if you’re searching for a companion to help you navigate your investing adventure, and start along the path to a more stable and profitable financial future.